QAU Alert 2017-01: AASC Q&A on the New Reporting Standards

Questions and Answers on the New Auditor’s Report

As per AASC Alert Series 001 of 2017, public practitioners may use these Q&As as their guide in complying with the new auditor reporting standards:

1. What are the new and revised auditor reporting standards that become effective for periods ended on or after December 15, 2016 and the changes thereto?

- PSA 700 (Revised), Forming an Opinion and Reporting on Financial Statements

- PSA 701 Communicating Key Audit Matters in the Independent Auditor’s Report

- PSA 260 (Revised), Communication with Those Charged with Governance

- PSA 570 (Revised), Going Concern

- PSA 705 (Revised), Modifications to the Opinion in the Independent Auditor’s Report

- PSA 706 (Revised), Emphasis of Matter Paragraphs and Other Matter Paragraphs in the Independent Auditor’s Report

- PSA 720 (Revised), The Auditor’s Responsibilities Relating to Other Information

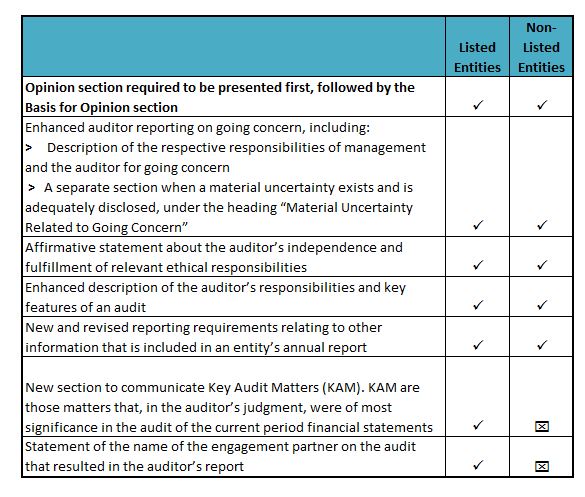

2. What are the key changes in the new auditor’s report relevant to listed and non-listed entities?

3. How should the auditor reference the Code of Ethics and other regulatory requirements in its affirmative statement of independence and fulfillment of relevant ethical responsibilities in the auditor’s report?

The auditor’s affirmative statement of compliance and fulfillment of relevant ethical responsibilities shall read as follows:

“…..We are independent of the Company in accordance with the Code of Ethics for Professional Accountants in the Philippines (Code of Ethics) together with the ethical requirements that are relevant to our audit of the financial statements in the Philippines, and we have fulfilled our other ethical responsibilities in accordance with these requirements and the Code of Ethics…”

4. Do KAM apply to audits of public companies which are defined in Securities Regulation Code (SRC) Rule 68, As Amended, Part I (3)(B)(a)(c) as entities with assets of at least Php50 million and have two hundred (200) or more holders each holding at least one hundred (100) shares of a class of its equity securities?

No. KAM is required only for audit of listed entities whose shares or debt are quoted or listed with the recognized stock exchange or equivalent body such as the Philippine Stock Exchange (PSE) and the Philippine Dealing and Exchange Corp. KAM does not apply to delisted entities as of reporting period.

5. When the auditor is required to communicate KAM in respect of the audit of the consolidated financial statements, and the auditor is also required to express an audit opinion on the separate financial statements of the parent or holding company (hereinafter referred to as separate financial statements), is the auditor also required to communicate KAM in respect of the audit of the separate financial statements?

The requirement of communicating of KAM is met when it is provided in the auditor’s report covering audits of consolidated financial statements of listed entities. Thus, the auditor need not communicate KAM in respect of the audit of separate financial statements.

In the case of financial institutions, the auditor’s report covers the audit of both the separate and consolidated financial statements in a single report. The auditor’s report on the financial statements of the listed banks which are parent companies shall include KAM for the audits of both the separate and the consolidated financial statements.

6. In describing the procedures performed to address the KAM for group audits, may the group auditor include the procedures performed by the component team?

Yes. As provided by PSA 600, the group audit opinion is the responsibility of the group auditor even if the component auditors may perform work on the financial information of the components for the group audit. The group auditor is responsible for the direction, supervision and performance of the group audit engagement.

7. What constitutes “Other Information” under our local jurisdiction?

- SEC Form 20-IS (Definitive Information Statement)

- SEC Form 17-A

- Annual Report

8. Given the other information identified in item 7 above, how should the Other Information section be presented where the auditor has obtained no other information prior to the date of the auditor’s report but expects to obtain other information after the date of the auditor’s report?

“Other Information

Management is responsible for the other information. The other information comprises the information included in the SEC Form 20-IS (Definitive Information Statement), SEC Form 17-A and Annual Report for the year ended December 31, 20X1, but does not include the financial statements and our auditor’s report thereon. The SEC Form 20-IS (Definitive Information Statement), SEC Form 17-A and Annual Report for the year ended December 31, 20X1 are expected to be available to us after the date of this auditor’s report.

Our opinion on the financial statements does not cover the other information and we will not express any form of assurance conclusion thereon.

In connection with our audits of the financial statements, our responsibility is to read the other information identified above when it becomes available and, in doing so, consider whether the other information is materially inconsistent with the financial statements or our knowledge obtained in the audits, or otherwise appears to be materially misstated.”

…XXX…

Related Alerts

-

December 27, 2017

-

December 27, 2017

-

December 27, 2017

-

October 25, 2016

-

October 21, 2016

-

October 21, 2016

-

October 20, 2016

-

October 20, 2016

-

October 20, 2016

-

October 20, 2016

-

October 20, 2016

-

October 20, 2016

-

October 20, 2016

-

October 20, 2016

-

October 20, 2016

-

October 20, 2016

-

October 20, 2016

-

October 19, 2016

-

October 19, 2016

-

October 19, 2016

-

October 19, 2016

-

October 19, 2016

-

October 19, 2016

-

October 19, 2016

-

October 19, 2016

-

October 19, 2016

-

October 19, 2016

-

January 21, 2016

-

June 01, 2015

-

May 27, 2015

-

July 31, 2013

-

June 30, 2013